Minimizing the impact of the Affordable Care Act just got a lot easier.

Lets face it, the Affordable Care Act (ACA) is very complicated. We understand this, which is why we provide individual attention to each company’s situation to craft an innovative solution that meets their specific needs and budgets.

Simplifi HR Solutions provides innovative strategies to save employers thousands in premium dollars and eliminate potential ACA penalties. We provide options for ACA compliant plans ranging from traditional group plans, Minimum Essential Coverage plans, as well as our exclusive Captive Self-Funded Plan.

You need guidance with ACA and we can help. Our services include:

- Consultation and Planning

- ACA Compliance Strategies

- ACA Complaint Fully-Insured Group Plans

- Self – Funded ERISA Plans

- Captive Self – Funded Programs

- Association Programs

- IRS Tax Strategies

- Minimum Essential coverage “Skinny” Plans

- Complete Plan Administration

- Wellness Benefit Plans

- Voluntary Benefits

- Automated Enrollment

ARE YOU READY FOR 2015?

With the Employer Shared Responsibility provision of the Affordable Care Act about to become a serious reality in 2015 we are asking the following questions of our clients and non-clients:

- Are your prepared for the mandated reporting and compliance requirements of the Affordable Care Act?

- Under the “Pay to Play” provision, do you have a process in place that will determine “full time” status vs. “part time”?

- Are your prepared for the end of the year IRS reporting requirements?

- In the event that none of the above has taken place, are you prepared for the “pay” portion of the “pay or play” provision? It can be a SERIOUS cost to the employer.

The reporting and compliance requirements are more significant and complex than the above questions might suggest, and we are prepared to work with you in navigating the ever-changing requirements of the Affordable Care Act.

What to do for the remainder of 2014

- Employers should develop systems for tracking and reporting ACAA needed data.

- Health plans can no longer exclude coverage for the Pre-existing conditions.

- Wellness limits increase

- Waiting periods on health plans is limited to 90 calendar days.

- Large health plans must obtain health plan identifier (HPID) by November 5th, 2014.

- Mid-size employers (those with between 50-99 FTE employees) will need to apply for transitional relief of the Large Employer Mandate (pay to play rules) with the IRS.

What happens January 1, 2015

- The Large Employer Mandate (pay or play rules) and associated IRS reporting begins for the first plan year starting on or after 1/1/15 for employers with 100 or more FTE employees.

- The employer must offer coverage to at least 70% of its full-time employees in 2015.

- The employer must offer coverage to at least 95% of its full-time employees in 2016 and thereafter.

- Small plans must obtain a health plan identifier (HPID) and begin reporting insurance coverage.

Health Insurance Trends Under the Affordable Care Act

Employers are facing more challenges than ever in managing health insurance

costs for their associates. Because of the Affordable Care Act (ACA), benefit dollars are being stretched to comply with payroll and benefit plan reporting, inclusion of mandated benefits, new minimum participation rules and affordability provisions. In addition, with most carriers, the market still lacks transparency in claims data, fee disclosures and justified renewals. The challenges to controlling costs seem to be rampant.

That’s where our solutions come to the rescue.

Employee Benefit Captives

An employee benefit captive is a better financial model for managing insurance risk. Historically captives were started by large single-employer companies (Fortune500) with more than 1,500 employees. Essentially, a captive is self-funding on a large scale where several medium, sized employers band together for shared savings.

Captive Benefits include:

- Reduced Volatility because participants are part of a larger group which spreads the risk evenly through pooling

- Profit Distributions increase the potential for reduced costs through the captive structure

- Improved Cost Efficiencies as the captive members are able to use the buying power of the larger group as a whole

Captive Plans Advantages Under the ACA include:

- Tax & Fee Savings– save on 4 fees that employers pay under community rating, which equals approximately 7% of premium

- No Community Rating Structure – the Captive Pool dictates rate actions, not governmental body

- No Medical Loss Ratio Restrictions – Profits in the captive are shared by the members

What does captive look like?

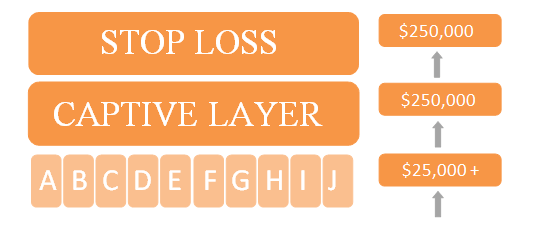

- Each participating company sets their own plan options and specific claim stop loss (this illustrate is set at $25,000).This is the Self-Funded Level.

- The entire pool shares the Captive Layer

- The reinsurance carrier pays at the Stop Loss level

With Simplifi’s Captive, you are joining a group of employers to pool experience to ensure increased stability and predictability year after year. You maintain control over your plan design and contribution strategy, so you offer the benefits that work best for your employees.

Self-Funded Level Cost Reductions

- Compass Health

- Pricing transparency and patient advocacy

- Compass Health Impact

- Lower healthcare costs by 10%

- Average savings of $620/employee

- 10:1 return on investment

- Our own pharmacy benefit manager

- Member retains all rebates, not a carrier

- Organ Transplant Benefit – this is insured outside of the pool

- Supplemental medical expense – Pool Cleaner

Pricing Transparency Examples

MRI Brain Market Analysis

| Location | In-Network Allowed Amount |

| Massachusetts General Hospital | $3,386 |

| Quincy Health Care | $1,378 |

| The MRI Centers of New England | $453* |

*total savings of $2,933 could be achieved between high cost and low cost service providers

Colonoscopy Market Analysis

| Location | In-Network Allowed Amount |

| Massachusetts General Hospital | $1,776 |

| Quincy Health Care | $1,187 |

| The MRI Centers of New England | $620* |

*total savings of $1,156 could be achieved between high cost and low cost service providers

Arthroscopic Knee Surgery Market Analysis

| Location | In-Network Allowed Amount |

| Massachusetts General Hospital | $3,756 |

| Quincy Health Care | $2,419 |

| The MRI Centers of New England | $1,493* |

*total savings of $2,263 could be achieved between high cost and low cost service providers

Wellness Programs – (Naturally Slim and Your Quest)

- Designed to identify and eliminate disease within an employee population

- Slow the projection of disease to flatten the trajectory of healthcare trend

- Impact

- 5% of employee population drives over 50% of total healthcare costs

- Outperform the market

Large Group Pricing and Stability

- Economies of Scale

- Market presence

- Simplifi Captive Pool participates in Five other EB captives

- Renewal premiums based upon larger group outperforming marketplace

- Service provider fees based upon program size

- Market presence

- Underwriting Credibility

- Larger groups are priced more accurately

- Larger groups buy less insurance